“`html

Key Takeaways

- US corporate bankruptcies are on the rise, driven primarily by specific types of businesses.

- Debt-heavy companies, especially those taken private by private equity firms, face significant financial strain.

- Retailers with dwindling consumer bases and outdated business models struggle to stay afloat.

- The energy sector is particularly vulnerable due to fluctuating oil prices and regulatory challenges.

- Tech startups, while innovative, often fail to achieve profitability quickly enough to survive.

- Economic factors such as interest rate hikes and inflation exacerbate the financial peril of these enterprises.

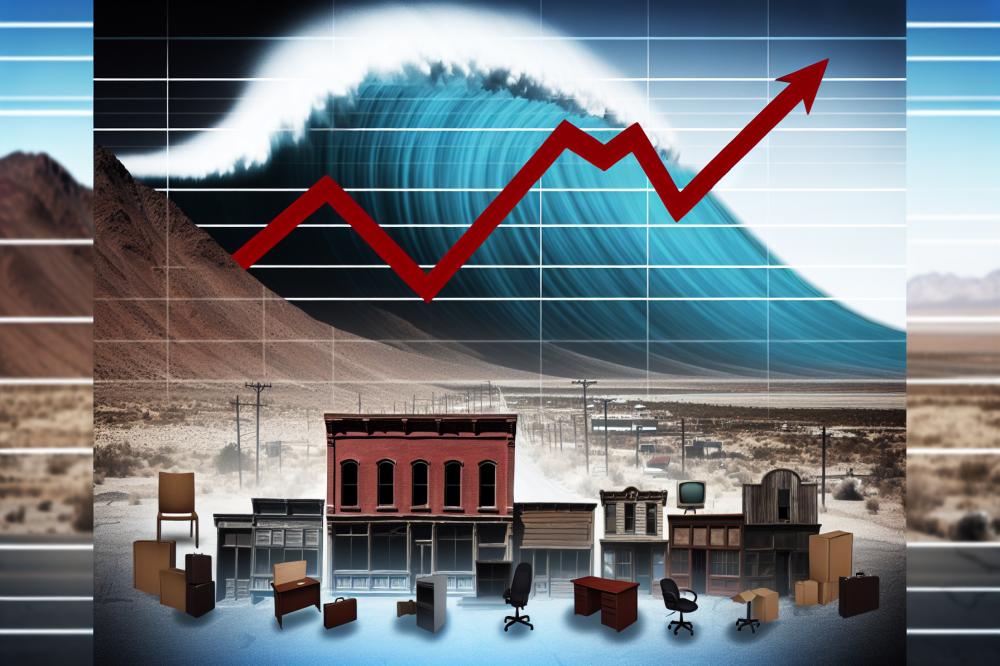

US corporate bankruptcies have surged, with a noticeable increase driven by specific types of businesses facing insurmountable financial obstacles. Among these, companies burdened with high levels of debt, particularly those taken private by private equity firms, are under significant pressure. For instance, many of these entities are finding it increasingly difficult to manage their debt loads, leading to liquidity crises and eventual insolvency. Moreover, retailers grappling with shrinking consumer bases and outdated business models are often unable to sustain their operations. As a result, many are filing for bankruptcy, unable to compete in a rapidly evolving marketplace.

The energy sector is another significant contributor to the rise in bankruptcies. Companies in this industry face unique challenges, including volatile oil prices and stringent regulatory requirements, which compound their financial difficulties. This has led to a wave of bankruptcies as firms are unable to adapt swiftly enough to survive these pressures. Simultaneously, tech startups, despite their innovative potential, frequently encounter issues related to profitability. These enterprises often require substantial capital investment and may not generate sufficient income quickly enough, leading to financial distress.

Economic conditions also play a crucial role in exacerbating the financial problems of these businesses. Factors like rising interest rates and inflation increase the cost of borrowing and operating expenses, putting additional strain on companies already in precarious positions. Consequently, businesses across various industries find themselves unable to navigate the challenging economic landscape, resulting in increased bankruptcy filings. Additionally, the current financial climate makes it harder for struggling companies to secure the necessary funding to stay afloat.

Overall, the article highlights the multifaceted nature of the bankruptcy surge, emphasizing the intersection of industry-specific challenges and broader economic pressures. For instance, while firms in disparate sectors share a common struggle with debt and financing, the underlying causes of their financial woes can vary significantly. The convergence of these factors creates a perfect storm, driving a significant number of US companies into bankruptcy.

Read the full story by:

clicking here

“`