Avoiding debt relapse after bankruptcy is crucial for a fresh financial start. Many individuals face challenges post-bankruptcy, risking falling back into debt. Understanding effective strategies and habits can prevent this relapse. By implementing smart budgeting techniques, building an emergency fund, and seeking professional financial advice, you can secure your financial future and avoid repeating past mistakes. Stay proactive in managing your finances to ensure long-term stability and success. Learn how to navigate the post-bankruptcy landscape with confidence and make informed decisions to safeguard your financial well-being.

Key Takeaways

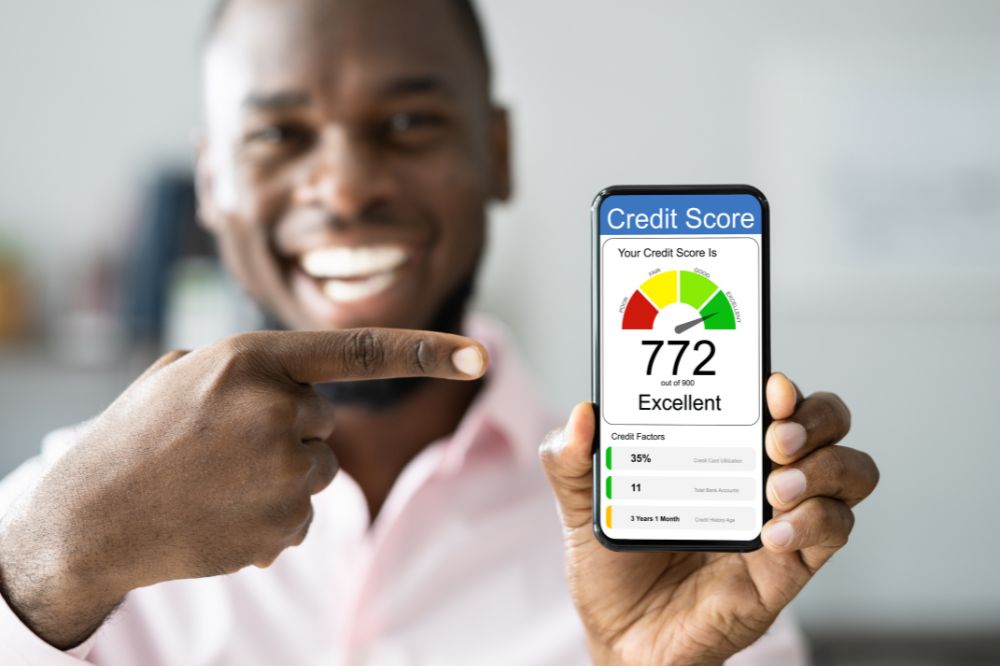

- Rebuilding Credit Wisely: Focus on using secured credit cards and making timely payments to gradually improve your credit score after bankruptcy.

- Financial Planning and Budgeting: Create a detailed budget, track your expenses, and prioritize saving to prevent falling back into debt post-bankruptcy.

- Navigating High-Interest Products: Be cautious of high-interest products like payday loans and car title loans, as they can lead to a cycle of debt; explore alternatives like credit unions or community banks.

- Enhancing Financial Literacy: Educate yourself on financial matters, seek out resources, and attend workshops to make informed decisions and avoid financial pitfalls.

- Building a Support System: Surround yourself with understanding and supportive individuals who can provide encouragement and guidance during challenging financial times.

- Setting Realistic Goals: Establish achievable financial goals, celebrate small milestones, and stay motivated on your journey towards long-term financial stability.

Understanding Bankruptcy

Credit report monitoring

Regularly check credit reports for errors or discrepancies. Set up credit monitoring alerts for any suspicious activity to catch potential issues early. Monitoring credit post-bankruptcy is crucial to ensure financial stability.

Avoiding scams

High-interest traps

- Be cautious of high-interest loans or credit offers that may lead to a debt cycle.

- Avoid falling into the trap of payday loans or cash advances, as they can worsen financial situations quickly.

- Seeking financial advice before committing to high-interest options can prevent further financial struggles.

Credit-repair frauds

- Stay vigilant against fraudulent credit repair companies promising quick fixes.

- Research and verify the legitimacy of any credit repair services before engaging with them.

- Be aware of common red flags indicating credit repair scams, such as guarantees of specific outcomes or upfront fees.

Maintaining Stability Post-Bankruptcy

Preserving paperwork

Organize and store bankruptcy and financial documents securely. Keeping these records in a safe place ensures easy access for any future reference or legal requirements. Understanding the significance of preserving paperwork is crucial for maintaining financial stability.

Keep records of all post-bankruptcy financial transactions to track your financial progress accurately. This documentation helps in monitoring your expenses, income, and overall financial health after bankruptcy. It also serves as evidence in case of any disputes or audits.

Understanding the importance of preserving paperwork goes beyond just filing them away. These documents can provide valuable insights into your financial decisions, helping you make informed choices and avoid repeating past mistakes.

Job and home steadiness

Focus on maintaining stable employment and housing situations post-bankruptcy. Securing a steady job ensures a consistent income flow to support your financial obligations and rebuild your creditworthiness. Prioritize job security to enhance long-term financial stability.

After bankruptcy, prioritize stabilizing your living arrangements to avoid further financial strain. Creating a plan to ensure stability in both work and home life is essential for rebuilding your finances effectively. This stability fosters a sense of security and control over your future financial well-being.

Rebuilding Credit Wisely

Timely Payments

Making timely bill payments is crucial for rebuilding credit post-bankruptcy. Setting up automatic payments or reminders can help ensure you never miss a due date. Establishing a routine to track payment schedules enhances financial discipline.

Balances Management

To prevent accumulation, it’s essential to monitor and control credit card balances diligently. Aim to keep balances low compared to credit limits to maintain a healthy credit utilization ratio. Implementing effective strategies can help manage and reduce outstanding balances efficiently.

Credit Card Application

Approach credit card applications cautiously after bankruptcy. Researching and comparing different options before applying is key. Understanding how credit inquiries affect credit scores is vital to make informed decisions.

Diversifying Credit

Exploring various types of credit accounts helps diversify your credit profile post-bankruptcy. Consider opening a mix of credit cards, loans, and other credit accounts to showcase responsible credit usage. Understanding the benefits of having diverse credit sources can strengthen your financial standing.

Financial Planning and Budgeting

Saving strategies

When it comes to avoiding debt relapse after bankruptcy, saving strategies play a crucial role in maintaining financial stability. One key aspect is building an emergency fund. This fund acts as a safety net for unexpected expenses that may arise post-bankruptcy.

Prioritize building an emergency fund to ensure you have funds readily available for unforeseen circumstances. By starting small and gradually increasing your savings, you can create a solid financial cushion. Recognize the importance of this fund as it provides security and prevents falling back into debt.

Emergency fund

- Prioritize building an emergency fund for unexpected expenses

- Start small and gradually increase emergency savings over time

- Recognize the importance of having a financial safety net post-bankruptcy

Budget adherence

To maintain financial stability, it’s essential to adhere to a budget effectively. Create a realistic budget that aligns with your income and expenses. By tracking your spending habits, you can identify areas where adjustments are needed to stay within your budget limits.

Create and follow a realistic budget that covers all necessary expenses while allowing room for savings and debt repayments. Adjust the budget as needed based on changing circumstances or financial goals. Utilize budgeting tools or apps to streamline the process and help you stay organized and accountable for your finances.

Navigating High-Interest Products

Recognizing risks

After bankruptcy, individuals must identify potential financial risks such as predatory lending or high-interest products. Stay vigilant to address and mitigate these risks promptly to avoid falling back into debt. Seeking professional advice is crucial when uncertain about the risks involved in certain financial products.

Seeking alternatives

Exploring alternative financial solutions post-bankruptcy can be beneficial. Look beyond traditional banking options and consider community resources or non-profit organizations for additional support. Creative thinking is essential when facing financial obstacles after bankruptcy, leading to innovative solutions.

Enhancing Financial Literacy

Understanding credit

Educate yourself on credit scores, reports, and factors influencing credit. Understand how payment history impacts creditworthiness. Know the significance of credit utilization and types of credit accounts. Stay informed about credit-related terminology like APR, minimum payments, and due dates. Recognize the impact of bankruptcy on your credit score and financial health. Take steps to improve and maintain healthy credit post-bankruptcy by making timely payments.

Debt management education

Invest in financial literacy courses or workshops focusing on debt management post-bankruptcy. Learn effective strategies for debt repayment, such as snowball or avalanche methods. Understand budgeting techniques to manage expenses and savings effectively. Engage in continuous education to enhance debt management skills and make informed financial decisions. Seek guidance from financial advisors or counselors for personalized debt management plans.

Building a Support System

Financial counseling

Seek professional financial counseling to receive tailored guidance on managing finances post-bankruptcy. Discuss your financial goals and challenges with a certified counselor who can provide expert advice. Follow through on the recommendations given by financial counselors to stay on track.

Peer support groups

Join peer support groups or online forums specifically designed for individuals recovering from bankruptcy. Engage with others who have gone through similar financial struggles to share experiences and gain valuable insights. By participating in these groups, you can build a supportive network that offers both encouragement and practical advice.

Setting Realistic Goals

Short-term objectives

Setting achievable short-term financial goals is crucial for navigating the post-bankruptcy phase successfully. By establishing realistic targets, individuals can track their progress effectively. Breaking down larger financial objectives into manageable milestones helps prevent feeling overwhelmed.

Celebrating small victories along the way plays a significant role in maintaining motivation. These victories act as reminders of progress made and encourage individuals to continue working towards their long-term financial well-being.

Long-term aspirations

Defining long-term financial aspirations and objectives post-bankruptcy provides a sense of direction and purpose. Creating a detailed roadmap for achieving sustainable financial stability allows individuals to plan ahead and make informed decisions.

Staying committed to long-term goals is essential, but it’s equally important to remain flexible and adapt to changing circumstances. By being adaptable, individuals can adjust their strategies while staying focused on their ultimate financial objectives.

Preparing for Challenges

Anticipating setbacks

Prepare for potential setbacks or challenges in the financial recovery journey. Develop contingency plans to address unexpected obstacles. Stay resilient and adaptable in the face of setbacks post-bankruptcy.

Facing financial challenges after bankruptcy can be daunting. It’s crucial to anticipate possible setbacks and have strategies in place to overcome them. Developing contingency plans ensures you are prepared for any unexpected obstacles that may arise along the way. Staying resilient is key to navigating through these challenges with determination and adaptability.

Resilience building

Cultivate resilience through a positive mindset and determination. Practice self-care and stress management techniques during financial challenges. Embrace setbacks as learning opportunities for personal growth and resilience.

Building resilience is essential for maintaining a strong mindset throughout your financial recovery journey. Cultivating a positive outlook and staying determined can help you overcome obstacles more effectively. Practicing self-care and stress management techniques can provide you with the necessary support during challenging times. Embracing setbacks as opportunities for personal growth can further enhance your resilience in the face of adversity.

Final Remarks

After bankruptcy, staying financially stable is crucial. By rebuilding credit wisely, planning your finances, and enhancing your financial literacy, you can prevent falling back into debt. Remember to navigate high-interest products cautiously, build a support system, set realistic goals, and prepare for challenges ahead. These steps will empower you to overcome financial hurdles and secure a stable future.

Take charge of your financial well-being by implementing the strategies discussed. Stay informed, be proactive in managing your finances, and seek support when needed. By following these guidelines and staying committed to your financial goals, you can avoid debt relapse after bankruptcy and pave the way for a brighter financial future.

Frequently Asked Questions

How can I avoid falling back into debt after bankruptcy?

To avoid debt relapse post-bankruptcy, focus on financial planning, budgeting wisely, and rebuilding credit cautiously. Stay informed about high-interest products, enhance financial literacy, build a strong support system, set achievable goals, and prepare for potential challenges ahead.

Is it important to understand the implications of bankruptcy before filing?

Yes, understanding bankruptcy’s impact is crucial. It helps you make informed decisions, manage expectations post-bankruptcy, and navigate the process effectively. Seek professional advice to comprehend the legal aspects, consequences, and responsibilities associated with declaring bankruptcy.

What steps should I take to rebuild my credit score after bankruptcy?

Rebuilding credit post-bankruptcy requires patience and strategic efforts. Start by obtaining a secured credit card, making timely payments, keeping credit utilization low, monitoring your credit report regularly for errors or discrepancies, and gradually demonstrating responsible credit behavior to improve your score over time.

How can financial literacy help prevent future financial difficulties after bankruptcy?

Enhancing financial literacy equips you with essential knowledge and skills to make sound financial decisions. By understanding concepts like budgeting, saving strategies, debt management, and investment basics, you can proactively safeguard yourself against potential financial pitfalls and confidently navigate your post-bankruptcy journey towards stability.

Why is setting realistic financial goals essential for long-term success after bankruptcy?

Setting realistic financial goals post-bankruptcy provides a roadmap for your financial recovery journey. By establishing achievable milestones and tracking your progress, you stay motivated, focused, and accountable. This approach helps you build momentum, celebrate small victories along the way, and ultimately achieve sustainable financial stability.