Key Takeaways:

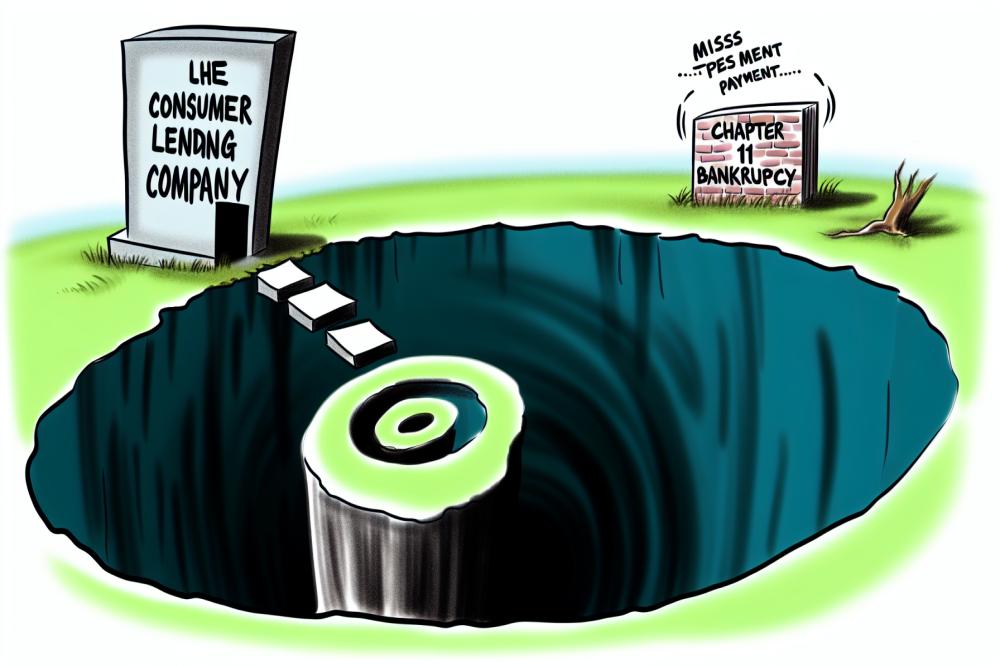

- The article discusses a major consumer lender that has missed payments and filed for Chapter 11 bankruptcy.

- The lender’s bankruptcy filing is significant due to its size and impact on the lending industry.

- Various factors have contributed to the lender’s financial difficulties, including economic challenges and regulatory issues.

- Customers of the lender may be affected by the bankruptcy, leading to potential changes in loan terms and customer service.

Amidst financial turmoil, a leading consumer lender faced with missed payments and mounting debt has resorted to seeking protection under Chapter 11 bankruptcy. This lender’s decision, laden with implications for the financial landscape and its customer base, underscores the deep-rooted challenges within the lending industry. Diving into the intricacies, the article unveils a backdrop of economic strains and regulatory hurdles that have precipitated the lender’s downfall, casting a shadow over its future sustainability. With the lender’s filing for bankruptcy, the looming specter of uncertainty looms over its customers, potentially heralding changes in loan agreements and customer support dynamics.

As events unfold, the reverberations of this consumer lender’s fall from grace may ripple through the wider financial ecosystem, underscoring the fragility that underlies even prominent industry players. In a sector where stability and trust are paramount, the lender’s missteps serve as a cautionary tale, magnifying the need for robust risk management strategies and vigilant oversight. The repercussions of this bankruptcy filing extend beyond mere numbers on balance sheets, signaling a broader reckoning with systemic vulnerabilities and the imperative for resilience in the face of unforeseen challenges.

Embarking on a journey fraught with uncertainty and potential ramifications, the consumer lending industry braces for the aftershocks of this seismic event. The interplay of economic forces and regulatory pressures sets the stage for a transformative period, where adaptability and foresight will be pivotal in navigating the uncharted waters ahead. In this evolving landscape, stakeholders are left to grapple with the implications of a once-mighty lender’s downfall, serving as a sobering reminder of the ever-present risks that underlie the financial realm.

Read the full story by: Clicking Here